Conference Presentation

Introduction

Overview of the strategic collaboration framework for financial inclusion and the conference objectives.

The International Fintech Conference in Bangladesh represents a pivotal moment for the country's financial sector transformation. With 45% of adults still unbanked, Bangladesh stands at a critical juncture where strategic collaboration between stakeholders can unlock unprecedented economic growth through financial inclusion.

Representing 45% of the adult population, this presents a massive opportunity for financial inclusion through fintech innovation.

Additional annual GDP growth achievable through comprehensive financial inclusion initiatives.

Strong digital infrastructure foundation with 103 million internet users ready for fintech adoption.

Strategic Importance

Why fintech is critical at Bangladesh's current juncture with 45% unbanked population and growth potential.

This large population often relies on informal financial channels which are unreliable, insecure, and costly.

Why Fintech is Critical Now

103 million internet users and 170 million mobile connections create a digital-ready population

Fintech can add 1.2-1.5% to annual GDP growth through financial inclusion

Young, tech-savvy population ready to adopt digital financial services

Neighbouring countries advancing rapidly in fintech innovation

Fintech Addresses Key Challenges

- Geographic Barriers: 68.34% of population lives in rural areas with limited bank branches

- Financial Literacy: Only 28% of population is financially literate

- Infrastructure Gaps: Limited traditional banking infrastructure

- Gender Disparity: Significant gap in women's access to financial services

Expanding Services

How fintech can expand savings, microcredit, and insurance services to reach underserved populations.

Fintech can dramatically expand access to essential financial services for Bangladesh's unbanked population, creating pathways to economic empowerment and financial security.

Conference Value

Benefits of bringing together diverse stakeholders for knowledge sharing and innovation acceleration.

An International Fintech Conference in Bangladesh would serve as a catalyst for innovation, collaboration, and policy development, bringing together diverse stakeholders to drive the country's financial inclusion agenda.

Access to global expertise and successful implementation models from countries with similar challenges. Learn from successes and failures in comparable markets.

Cross-pollination of ideas between sectors creates new solutions. Startups gain visibility while established players discover emerging technologies and business models.

Direct engagement between regulators and industry creates balanced frameworks that protect consumers while enabling innovation. Regulatory sandboxes can emerge from these discussions.

Face-to-face interactions create trust and understanding between potential partners. Banks meet fintechs, investors connect with startups, and universities link with industry.

Success Story: Singapore Fintech Festival

The world's largest fintech festival brings together 60,000+ participants from 140+ countries annually.

In investments and business deals generated in 2023

Implemented across participating countries based on insights gained

Key Outcomes:

- Regulatory harmonisation across ASEAN

- Cross-border payment initiatives

- Digital currency experimentation

- Financial inclusion acceleration

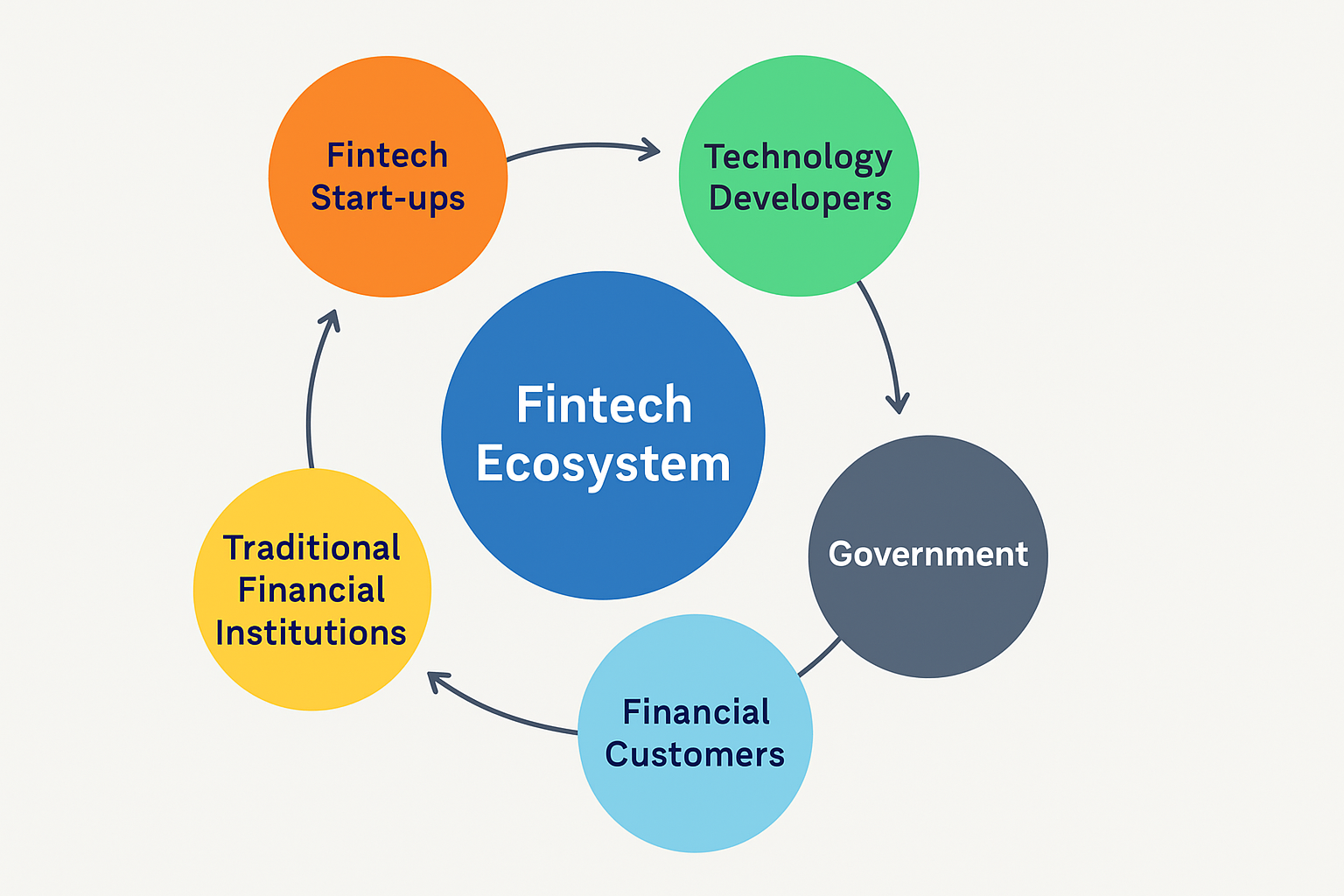

Key Stakeholders

How government, banks, fintechs, IT companies, telecoms, and universities would benefit from participation.

An International Fintech Conference brings together diverse stakeholders, each with unique contributions and benefits.

Collaborative Platform

Framework for ongoing stakeholder engagement and policy development to support innovation.

Beyond the conference, a permanent collaborative platform is needed to enable ongoing stakeholder engagement, policy development, and innovation support.

A multi-stakeholder governance structure with representation from government, regulators, financial institutions, fintechs, technology providers, and academia.

- Quarterly steering committee meetings

- Working groups focused on specific challenges

- Annual public forum for broader engagement

A structured process for identifying policy needs, developing recommendations, and implementing regulatory changes.

- Evidence-based policy research

- Regulatory sandbox for testing innovations

- Public consultation process for new regulations

Resources and programs to nurture fintech startups and support established players in digital transformation.

- Fintech incubator and accelerator programs

- Technical assistance for digital transformation

- Funding mechanisms for early-stage innovations

Economic Impact

Potential GDP growth, job creation, and efficiency improvements through increased financial inclusion.

The International Fintech Conference and subsequent collaborative platform will drive significant economic benefits for Bangladesh through increased financial inclusion and digital innovation.

Through increased financial inclusion, formal savings mobilisation, and more efficient capital allocation. This represents approximately $4-5 billion in additional economic output annually.

Direct employment in fintech companies, financial institutions' digital divisions, and supporting industries. Includes high-skilled technology roles and agent banking networks in rural areas.

Bringing the unbanked population into the formal financial system through mobile banking, digital wallets, and agent networks. This represents a 67% increase in financial inclusion rates.

Enhanced credit scoring through alternative data sources enables banks to serve 15 million small businesses previously excluded from formal credit markets, boosting entrepreneurship and economic growth.

Through digitisation of financial processes, automated compliance, and reduced need for physical infrastructure. Enables financial institutions to serve previously unprofitable customer segments.

Digital transactions are significantly cheaper than cash-based alternatives, freeing up capital for productive investments and reducing reliance on informal financial channels.

Call to Action

Proposed timeline, objectives, and invitation for stakeholder participation in the conference.

The time for action is now. Bangladesh has the opportunity to become a regional leader in fintech innovation and financial inclusion through strategic collaboration and coordinated effort.

Conference Objectives

Create lasting collaborations between government, financial institutions, fintechs, and technology providers to drive innovation and financial inclusion.

Establish a comprehensive strategy for fintech development with clear milestones, responsibilities, and success metrics for all stakeholders.

Create a permanent collaborative framework for ongoing policy development, innovation support, and stakeholder engagement beyond the conference.

Implementation Timeline

Join the Movement

Be part of Bangladesh's fintech transformation. Together, we can build a financially inclusive future that drives economic growth and improves lives.